Make An Efficient Payroll Statement Template Using These Tips And Components

How to register for PAYE with HMRC, making your business an EMPLOYER. Not a bad process, but there are a couple of quirks to watch out for.I'm neck deep in m.

How to Register for HMRC Self Assessment online? YouTube

Step 6. Select Add new product registration to register new or additional PAYE : A message will display to indicate that demographic information is prepopulated on the RAV01 form. You will be able to provide additional addresses and contact details if the existing demographic details are not used for PAYE.

Do I need an Accountant to Register for PAYE? The Cheap Accountants

PAYE stands for 'Pay As You Earn' and has been around since the 1940s. As an employer using PAYE, you pay your staff's tax contributions to HMRC directly from their pay. This means when an employee receives their salary, all their deductions for tax and payments like student loan repayments have already been made.

Register with Quest Pay Solutions Quest Pay Solutions

Business tax. PAYE. Register as an employer for PAYE: service availability and issues. HM Revenue. & Customs.

Accountants For Payroll and PAYE Registration Cheap Accountants

What is PAYE. How to set up PAYE in five steps. Register as an employer. Maintain and keep PAYE management records. Provide HMRC with details about your new employees. Calculate pay and dedcutions and report these to HMRC. Pay tax and National Insurance to HMRC.

Send an Employer Payment Summary using Basic PAYE Tools GOV.UK

To set up your payroll, first register as an employer with HMRC. HMRC will then send you your PAYE Reference and your PAYE Accounts Office Reference (don't confuse them!). You will need both these numbers in order to file your payroll data to HMRC. Now decide whether you want to run payroll in-house or outsource it.

How to register for PAYE on eFiling South African Revenue Service

PAYE is operated by employers as part of their payroll, deducting tax and National Insurance before paying an employee their wages. Other deductions, such as pension contributions or student loan repayments, can also be processed through payroll. Employers basically act as a tax collector on behalf of HMRC, deducting the tax that an employee.

How to Register for PAYE on eFiling Searche

Provide the date you closed your PAYE scheme in the 'Date scheme ceased' box (future dates are not allowed). Send your expenses and benefits returns. Enter a leaving date on each employee's payroll record. Provide your employees with a P45 on their last day.

How to register for PAYE Checkatrade

PAYE (also known as Pay As You Earn) was first introduced in 1994 and is a system used in the UK that collects income tax and National Insurance contributions from employees' salaries or wages. Here, the employers take care of deducting the correct amount of income tax and National Insurance contributions from their employee's paychecks and.

≫ How To Register For Paye On Efiling The Dizaldo Blog!

You'll need to set up a Government Gateway account in order to access HMRC's online services.. There are 3 types of account: individual accounts; organisation accounts

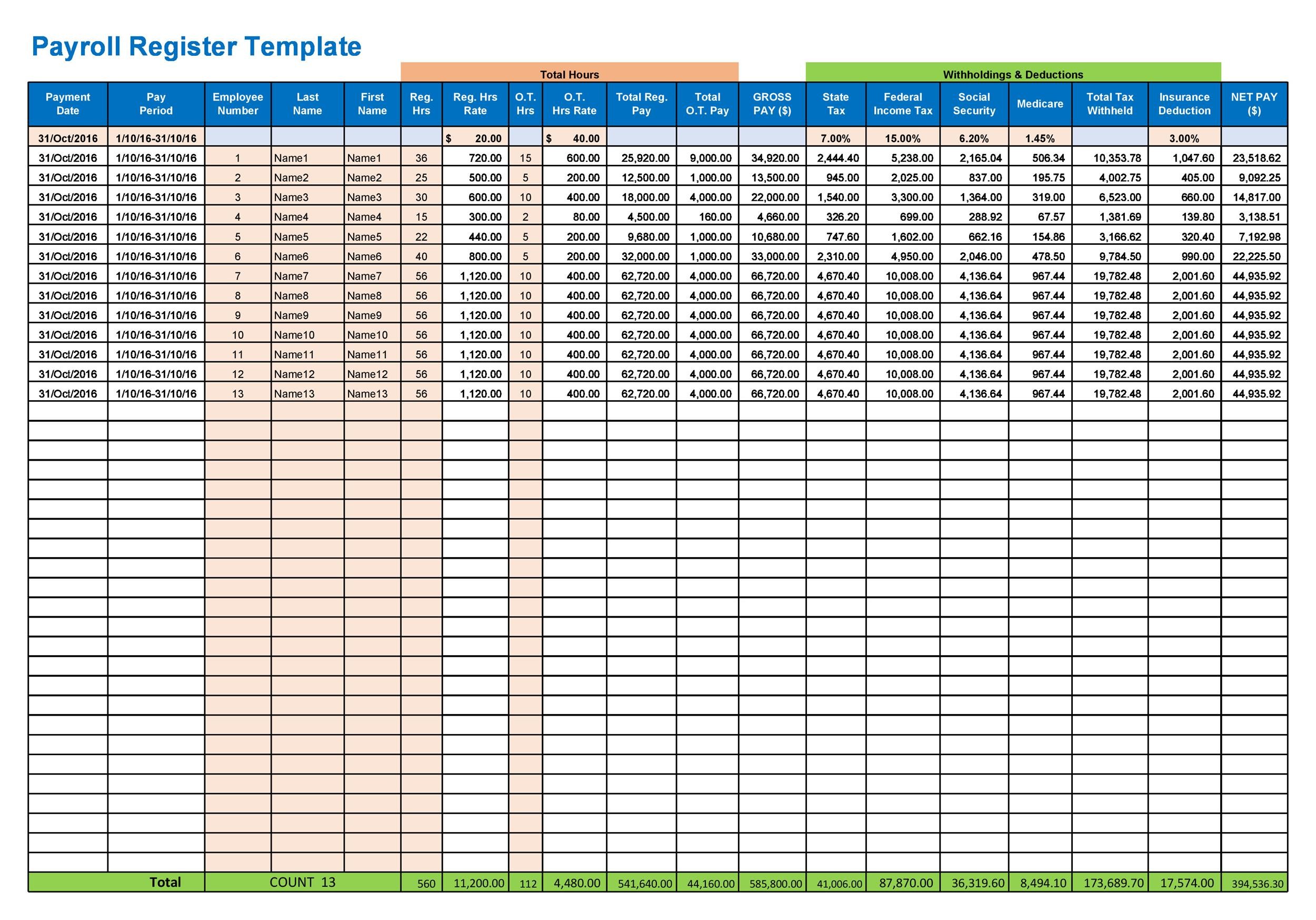

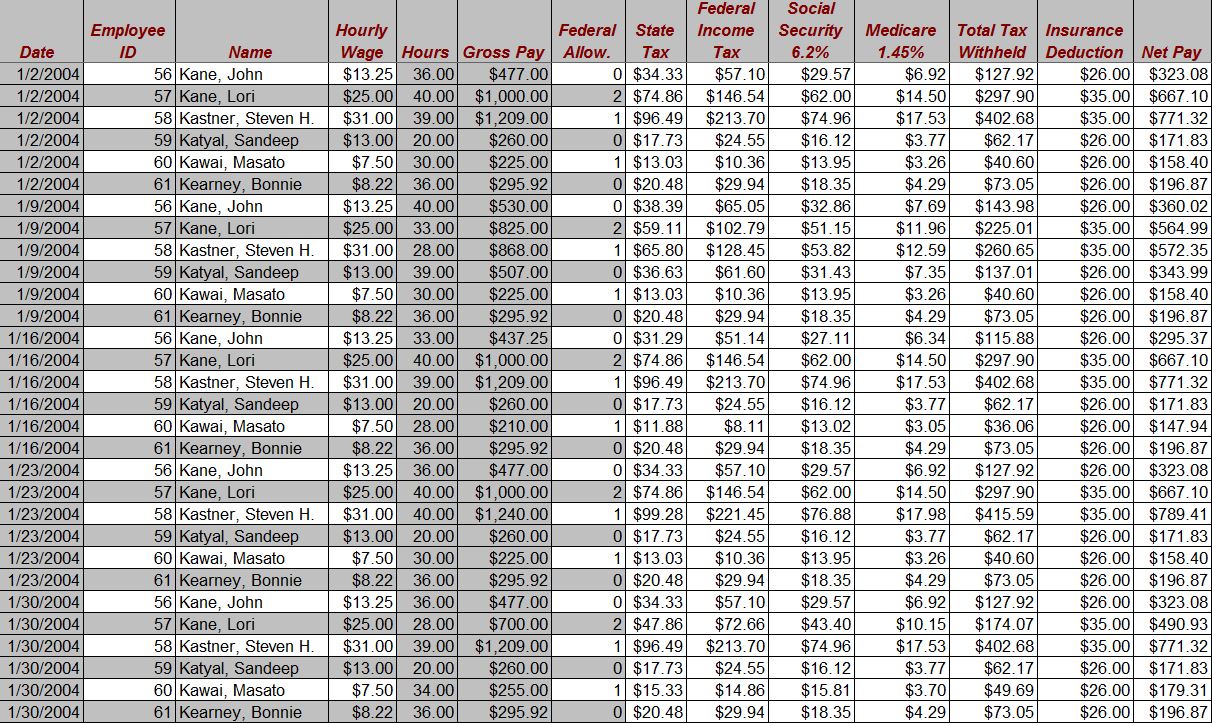

Sample Payroll Register Payroll Register Sample

How to register. You can register in several ways: online on GOV.UK (you will need to sign into your government gateway account to complete form CWF1) phoning the HMRC helpline for the newly self-employed. completing this on screen form and printing it off and posting it to HMRC. The registration process covers both tax and National Insurance.

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

Here's how the employer registration process for a limited company works: 1 - Begin the registration process. Follow this linkto begin the registration process on HMRC. You will be asked whether at least one company director has a UK national insurance number. If the answer is yes, click "yes" and continue.

Register for PAYE Purposes in Ireland YouTube

Register as an employer with HM Revenue and Customs (HMRC) and get a login for PAYE Online. Choose payroll software to record employee's details, calculate pay and deductions, and report to HMRC.

How to Set Up & Register for PAYE as an Employer

Follow HMRC guidance. The basic guidance says : " If you satisfy the requirements and think that an annual scheme might apply to you, contact HMRC's Payment enquiry helpline and have your Accounts Office reference number to hand. The Payment Enquiry helpline number is 0300 200 3401, but failing that, call the Employer Helpline on 0300 200 3200.

Hourly to monthly pay calculator YaseminHeilyn

You must register before the first payday. It can take up to 30 working days to get your employer PAYE reference number. You cannot register more than 2 months before you start paying people.

Register NetDirectPro

Registering as an Employer. According to law, an employer must register with the South African Revenue Service (SARS) within 21 business days after becoming an employer, unless none of the employees are liable for normal tax. For Employers - if you want to apply for registration of Payroll taxes: How to register for PAYE on eFiling.