Discretionary Trusts Everything You Need to Know BOX Advisory Services

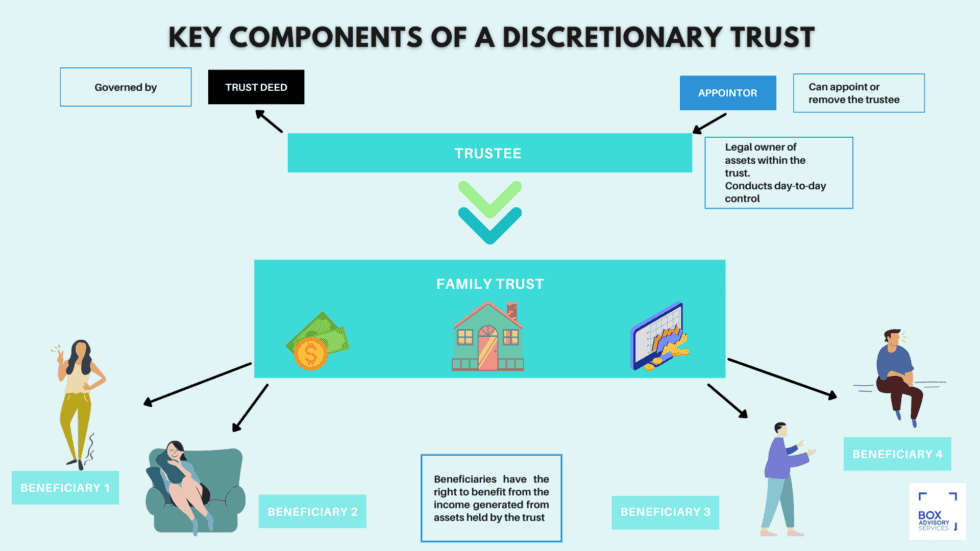

Discretionary trusts in wills explained. 02 August 2021. A discretionary trust is when money or other assets from your estate are left in trust. The trust is managed by appointed trustees who decide which people become beneficiaries and when and how they should receive inheritance from the trust.

CreatingADiscretionaryTrust Books for Creating a Discretionary Trust Law Books

Discretionary taxes. On the IHT side, anything you pay into a discretionary trust is regarded as a 'chargeable lifetime transfer'. As such, if you transfer more than the £325,000 nil rate band over a seven-year period and you'll pay a 20 per cent tax charge on any excess. There's also a further 6 per cent tax charge at each 10-year.

Family and Discretionary Trusts Explained Simply SWOT Accountants

Value of trust fund forms a part of the beneficiaries' estate and may be liable to IHT on the beneficiary's death. An adult beneficiary can demand satisfaction of rights immediately. Value of trust fund may be used in divorce or bankruptcy settlements of a beneficiary. Settlor Excluded Discretionary Trusts

Discretionary Trust Video Estate Planners Toolkit

One of the main disadvantages of a discretionary trust is the lack of transparency between the trustee and the beneficiary. The trustee has a great deal of discretion over how the trust funds are used, and there is no requirement for a beneficiary to be notified of all the trust decisions. This can lead to suspicion and resentment especially.

discretionary trust usa discretionary trusts disadvantages QFB66

Discretionary trusts. Will trusts and lifetime trusts can be structured in one of two ways: fixed interest, where the first beneficiary has an absolute right to stay in the house and receive the income from any trust investments; or

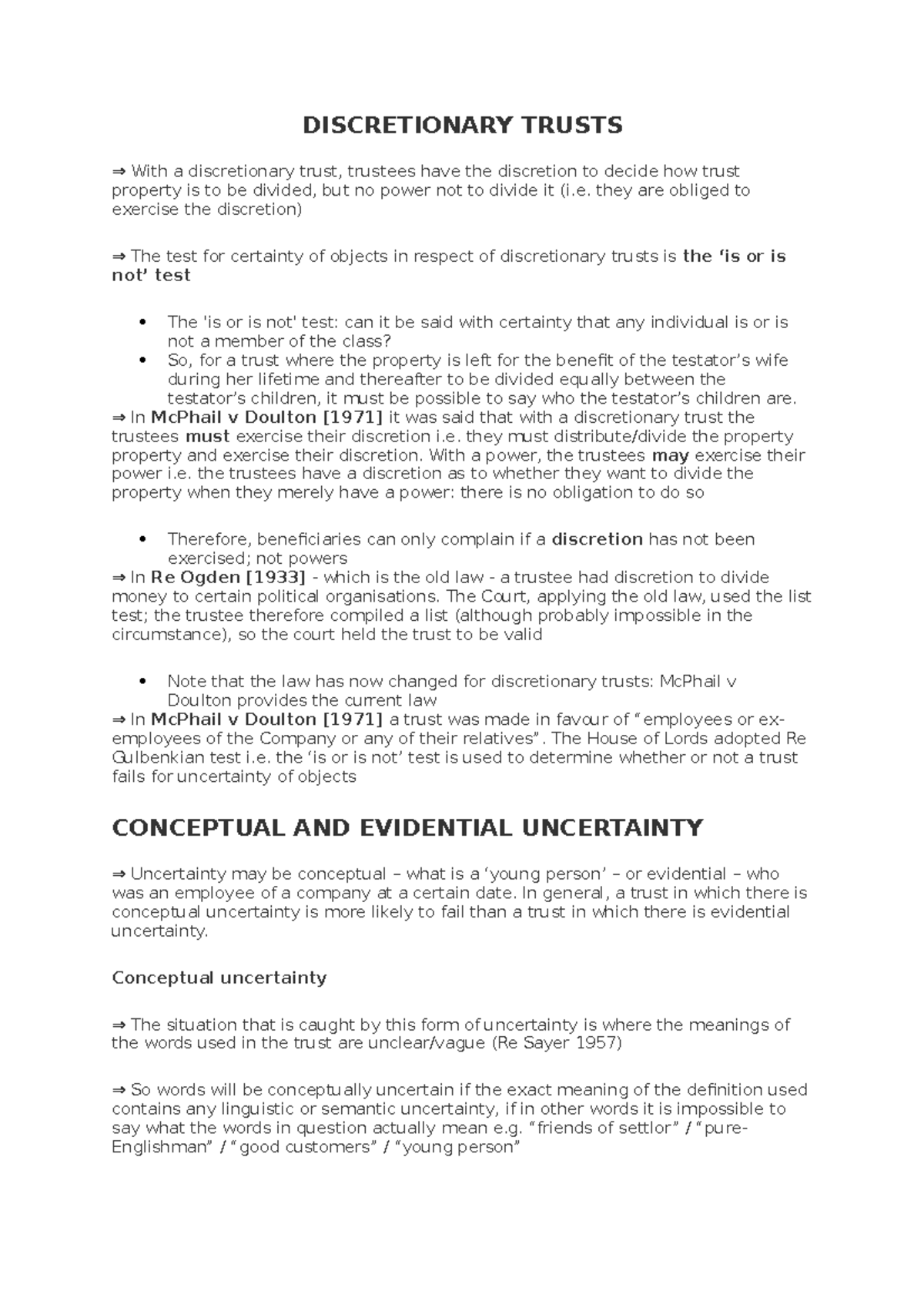

Trusts Notes DISCRETIONARY TRUSTS ⇒ With a discretionary trust, trustees have the discretion

The flexibility of discretionary trusts means they can be adapted to changing circumstances, even when the settlor has passed, such as a beneficiary falling on hard times. Discretionary trusts can last up to 125 years. A discretionary trust can be created when the settlor is alive, or in their will. Many uses.

Discretionary Trusts Advantages & Disadvantages Cashfloat

These include charges to tax every 10 years post-trust set up and exit charges on assets that are appointed out to beneficiaries. What are the advantages and disadvantages of discretionary trusts? Advantages. There are many advantages to discretionary trusts, including:

Discretionary Trusts & Rights of Beneficiaries Curtis Parkinson

Discretionary Trusts A trust is a legal arrangement whereby money, property or other assets ('the trust fund') are held and managed by persons ('the trustees') for the benefit of others ('the beneficiaries'). There are various types of trusts which perform a range of different functions. In the case of a trust

Understanding Fixed and Discretionary Trusts Loew Law Group

A discretionary trust is the most flexible form of trust as it enables the Trustees to use and distribute the income and capital of the trust entirely at their discretion. They have the power to either retain or distribute income as they see fit. A. Inheritance Tax position for Discretionary Will Trusts.

What is a Discretionary Trust? The Society of Will Writers

Discretionary trust is a sort of trust that is established to benefit one or more beneficiaries. This article focuses on Discretionary Trust, an example including their advantages, disadvantages, and tax implications.

Discretionary Trusts Everything You Need to Know BOX Advisory Services

Advantages of a Discretionary Trust. A discretionary trust can be beneficial for asset protection and tax purposes. Some potential benefits of this structure include: Estate planning for the benefit of members of the "family group" in the event of an unexpected death. Trust property is exempt from creditors.

How much does a discretionary trust will cost? YouTube

Discretionary Wills provide that part or all of a testator's assets are given to trustees to hold on discretionary trusts for the benefit of a number of specified beneficiaries. The discretionary trusts mean that during the trust period (typically 125 years from the testator's death) the trustees have discretion over how the assets in the.

What Is A Discretionary Trust? — Advantages And Disadvantages — Infographic by

Advantages. There are many advantages to discretionary trusts, including: flexibility and control - the trustees have the flexibility to adapt distributions according to the needs of the beneficiaries. asset protection - assets held by a discretionary trust are not owned by the beneficiaries meaning it allows for passing down wealth to.

What is a discretionary trust? Trent Wills and Estates

Structuring the discretionary trust to deal with these suspicions and mistrust is a major pre-occupation of financial planners, accountants and lawyers that advise on and arrange for the creation.

Discretionary Trusts Comasters Law Firm and Notary Public

There are several significant Discretionary Trust advantages that can easily sway a Trustor. Before you decide to select a Discretionary Trust as a part of your estate planning strategy, be sure to consider the disadvantages: Lack of control: The nature of a Discretionary Trust forces a Trustor to give up control. You can do what you can by.

The Role of Discretionary Trusts in Your Will Curtis Parkinson

As with other Trusts, a Discretionary Trust also offers certain tax relief benefits as well, including Income Tax and Capital Gains Tax. Inheritance Tax can also be minimised and we go into that in a bit more detail below. The disadvantages of a Discretionary Trust Will. As with most things, no Trust is perfect and that includes a Discretionary.